Informational Videos

Medicare insurance is a government-sponsored health insurance program available to most people aged 65 or older or who qualify due to disability. It’s divided into several sections with differing costs and choices.

Part A covers hospital treatment costs. In most cases there’s no premium payment, but recipients pay a deductible and also pay some coinsurance depending upon their medical treatments throughout the year.

Part B covers medical treatments outside of hospitals. Part B has an annual premium that is dependent on the recipient’s income and Social Security benefits. Recipients also pay a deductible and coinsurance.

Medicare recipients can also opt to take out a Medicare Advantage plan—sometimes called Part C. This means that the recipients will still pay for the Part B premium, but will get more choice over the balance of costs (premium, deductible and coinsurance) and coverage. They may also get coverage for services such as vision, hearing and dental that aren’t covered by ordinary Medicare.

Whichever plan you choose, the costs of prescription drugs are covered by Part D.

Medicare insurance can be a complicated issue, so please contact us today if you want to talk about your options.

Medicare Disclaimer: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

”I started with Unisource through a recommendation, and it has nothing short of great. Alex is over helpful and very considerate. Bob has been helpful in our time and professional too.

Sylvia R.

”I actually enjoy working with Bob and Alex. They are able to answer every single one of my questions. And is very prompt with responses.

Marcia W.

”I have been with Bob for several years and I am very pleased in choosing Unisource for my Medicare. I found out quick that either Bob or Alex is always available to talk.

Chuck R.

”Bob was extremely helpful from the start. I am very pleased; Bob help choose a Medicare plan that fit my specific needs. Alex is always helpful and quick to answer all of my follow-up questions.

George M.

”Alex was my first contact and she was very professional. Every business should answer the phone like she does. Bob is very knowledgeable. He suited a program around my needs and gave great benefits. I will recommend Bob and Alex.

Mark U.

”Alex is a fantastic person. She has the brightest spirit out there. Alex really goes above and beyond and is also very patient. I couldn’t recommend her enough!

Sandy E.

”I have only spoken with Alex on the phone, but from my experience she is super nice, knowledgeable, and friendly. Bob is too polite for his own good. They took care of my husband and now they take care of me. Bob seems to really connect with his clients and he is a down to earth person.

Carol Q.

”Alex M. at Unisource is a highly responsive and friendly resource for all things health insurance and Medicare!

Jenna V.

”Bob came to our house at our convenience. Extremely knowledgeable and went through our whole plan with us. We are extremely pleased and highly recommend Bob. We have recommended him to other people already, and will continue to do so!

Robert K.

”Bob is extremely thorough. He helped describe my plan in great detail. He helped me through the entire process, not only selecting, but signing up. He thoroughly described the Medicare advantage vs the Medigap plans to me.

Carol K.

”Bob's knowledge has given us “peace of mind” and a confidence that we are in the right program for us. I would be glad to personally talk to anyone thinking about healthcare needs and wondering where to go to get the support needed.

Tim Y.

”I have been working with Alex and she has been fantastic, knowledgeable and professional. She is quick to answer any question. If she says she is calling back, expect a prompt call back.

Richard F.

Let’s discuss your medicare insurance.

One of our insurance advisors will reach out to you to review your information and present you with the appropriate medicare insurance solution. There’s no obligation, just good-old-fashioned advice.

Unisource Insurance Associates offers medicare insurance throughout Wisconsin including, Milwaukee, Waukesha County, Washington County and Racine County.

Enroll in Original Medicare

Are you eligible?

People eligible for Medicare are 65 years of age or you’re under 65 and qualify on the basis of disability or other situation. AND you are a legal resident who has lived in the US for at least 5 consecutive years.

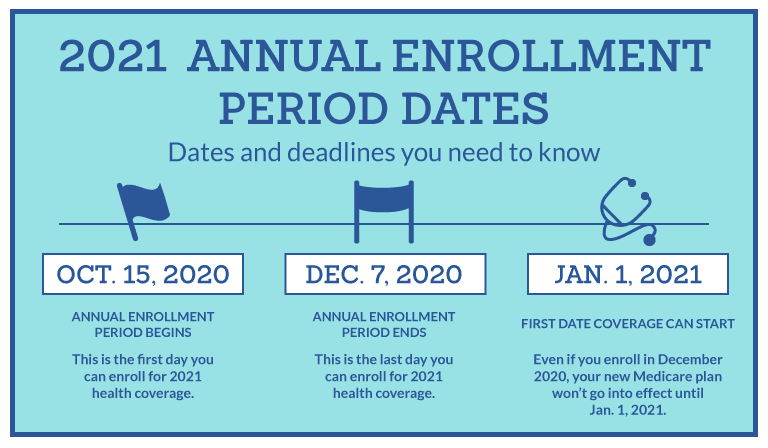

When can you enroll?

The Annual Enrollment Period: October 15 – December 7

During this period you are able to add, drop, or switch your Medicare coverage.

Medicare Advantage Open Enrollment Period: January 1 – March 31

If you are already a Medicare Advantage plan member, you may disenroll from your current plan and switch to a different Medicare Advantage plan one time only during this period.

Special Enrollment Period

Depending on certain circumstances, you may be able to enroll in a Medicare plan outside of the initial enrollment or annual enrollment time frames. Some ways you may qualify for a special enrollment period are if you:

- Retire and lose your employer coverage

- Move out of the plan’s service area

- Receive assistance from the state

- Have been diagnosed with certain qualifying disabilities or chronic health conditions

- Qualify for extra help

Medicare Choices

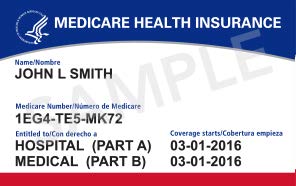

Example of the 2020 Medicare card